Our Trading Operations

Dedicated expert teams in the U.S., U.K. and APAC manage the entire execution lifecycle 24/6, following the sun with a proactive service approach.

Global Trading Operations: Expertise and Solutions Beyond the Trade

Our dedicated teams in the U.S., U.K. and APAC, averaging 20+ years of experience, manage the entire execution lifecycle from pre-trade setup and order initiation to the timely settlement and clearance of each order to our client’s custodian or prime broker, including custom end-of-day reporting.

Centralized operations reduce the costs and risks associated with numerous broker-dealer counterparties.

- Establish operations playbook tailored to client’s needs pre & post trade

- Maintain restricted lists and other high-level pre-trade compliance needs

- Support clearing for Tourmaline as counterparty and/or authorized direct-broker settlement

- Customize FIX tag capabilities to optimize client workflow

- 24x6 ‘follow-the-sun’ model for local operational support

- Trade Settlement, clearance and break resolution

- Leverage our deep relationships with Custodians/Prime Brokers to automate post trade workflows

- Expertise includes execution operations for trading and settling global equities / derivatives / ETFs / SWAPs

- Provide comprehensive reporting and website access for all trade detail

- Assist client compliance teams with local market regulatory requirements

- Manage all trade reporting obligations (under MiFID)

- Tailored transaction cost analysis (TCA) reporting

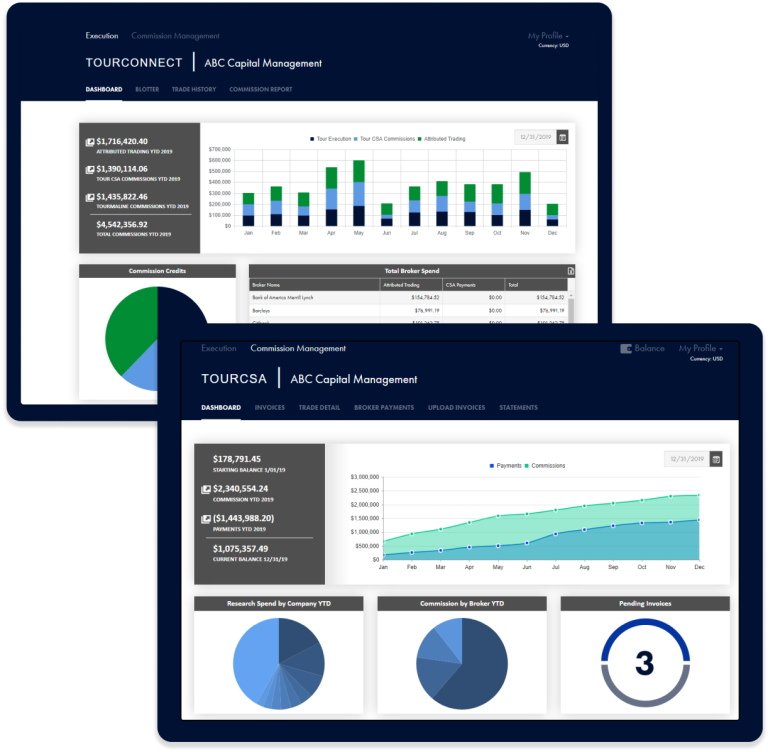

Tourmaline provides a comprehensive, centralized commission management offering for institutional clients through CCAs, CSAs, aggregation and attribution.

CCAs / CSAs / Aggregation / Attribution

- Execute with Tourmaline Partners or aggregate in business from the executing brokers of your choice

- In-house expertise, service and regulatory oversight

- Comprehensive reporting, transparency and 24/7 website access

Attributed Trading for Research Credit

- Direct specific trades or a budgeted research target to key sell-side brokers

- Tourmaline is your sole counterparty, creating operational efficiency

- Custom EOM reporting, FIX tagging and website detail

Service & Expertise

- 24-hour access to our secure, encrypted website

- Online payment review & approval interface

- Detailed reporting including month-by-month and YTD accounting of research commissions, spending and sell-side attribution

- Archived/full audit trail of historical CCA/CSA business

- Research Payment Anonymity

- Compliance and CCA/CSA Oversight